How are exchange rates determined under the gold standard

Log in Sign up. How can we help? What is your email?

Upgrade to remove ads. The institutional framework with which international payments are made, movements of capital are accomplished, and exchange rates among currencies are determined.

Macro quiz lesson #11 Flashcards | Quizlet

International monetary system established before International exchange rates were mostly determined by their gold and silver contents.

Countries that were on this standard often experienced Gresham's Law.

Bad abundant money drives out good scarce money. An international gold standard exists when: International Monetary standard in which domestic money stock should rise and fall as gold flows in and out of the country.

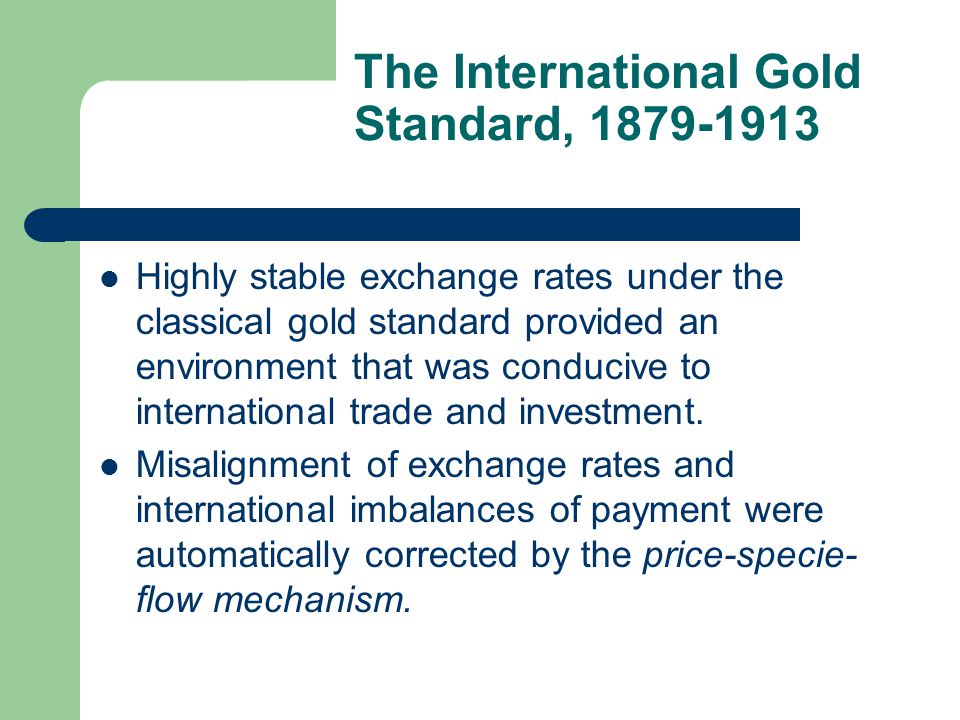

In this International Monetary standard, misalignment of the exchange rate would automatically be corrected by cross-border flows of gold. In this International Monetary standard, imbalances of payment would be automatically corrected.

How Exchange Rates WorkAs a result, no country may have a persistent trade deficit or surplus. This International monetary system was between This International Monetary system was between This period was characterized by economic nationalism, halfhearted how are exchange rates determined under the gold standard and failure to how are exchange rates determined under the gold standard the gold standard, economic and political instabilities, bank failures, and panicky flights of capital across borders.

International Trade and Investment. During the Interwar Period betweenthere was no coherent international monetary system that prevailed. During the Interwar Period, the U. Triffin Paradox, Run on the Dollar. Interest Equalization Tax IET.

A defense measure created by John Kennedy to increase the cost of foreign borrowing in the US bond market. Foreign Credit Restraint Program. A program introduced by the Fed factors affecting stock markets regulated the amount of dollars U.

This means that in addition to gold and foreign exchanges, countries could use the SDR to make international payments. The Flexible Exchange Rate Regime. This system was established in and is still current today.

Flexible exchange rates were declared acceptable to IMF members, with central banks being allowed to intervene in the exchange markets to smooth out unwarranted volatilities 2.

Fixed exchange-rate system - Wikipedia

Non oil-exporting countries and less-developed countries were given greater access to IMF funds. Starting in the mid s, based on continued US trade deficits, the dollar declined in value relative to other currencies.

What is the rate of exchange and how it is determined under gold standard

To pave the way for the eventual European monetary union. InEU members signed the Maastricht Treaty, stating: The EU bank would be located in Frankfurt, Germany and would be solely responsible for issuance of common currency and conducting monetary policy in euro-zone 3. Further benefits are political cooperation and peace in Europe. The key arguments for flexible exchange rates are: