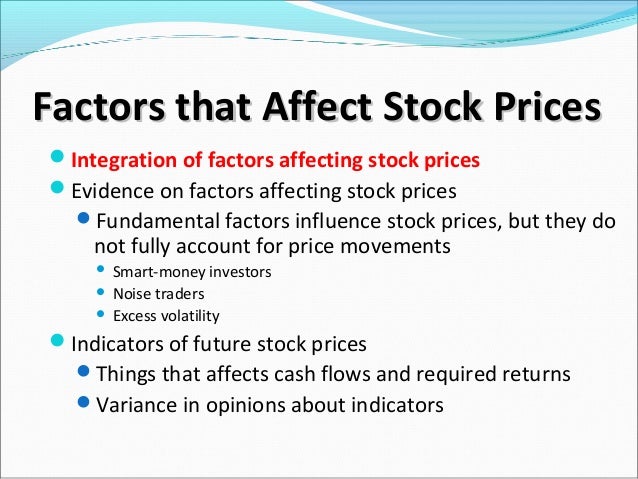

Factors affecting stock markets

Have you ever wondered about what factors affect a stock's price?

Factors Affecting the Stock Market | Economics Help

Stock prices are determined in the marketplace, where seller supply meets buyer demand. But unfortunately, there is no clean equation that tells us exactly how a stock price will behave. That said, we do know a few things about the forces that move a stock up or down. These forces fall into three categories: Fundamental Factors In an efficient market, stock prices would be determined primarily by fundamentals, which, at the basic level, refer to a combination of two things: An owner of a common stock has a claim on earnings, and earnings per share EPS is the owner's return on his or her investment.

When you buy a stock, you are purchasing a proportional share of an entire future stream of earnings. That's the reason for the valuation multiple: Part of these earnings may be distributed as dividends , while the remainder will be retained by the company on your behalf for reinvestment.

We can think of the future earnings stream as a function of both the current level of earnings and the expected growth in this earnings base. To learn about present value, see Understanding the Time Value of Money. About the Earnings Base Although we are using EPS, an accounting measure, to illustrate the concept of earnings base, there are other measures of earnings power.

Many argue that cash-flow based measures are superior. For example, free cash flow per share is used as an alternative measure of earnings power.

The way earnings power is measured may also depend on the type of company being analyzed. Many industries have their own tailored metrics. Real estate investment trusts REITs , for example, use a special measure of earnings power called funds from operations FFO. Relatively mature companies are often measured by dividends per share, which represents what the shareholder actually receives.

About the Valuation Multiple The valuation multiple expresses expectations about the future. As we already explained, it is fundamentally based on the discounted present value of the future earnings stream. Therefore, the two key factors here are 1 the expected growth in the earnings base, and 2 the discount rate , which is used to calculate the present value of the future stream of earnings.

A higher growth rate will earn the stock a higher multiple, but a higher discount rate will earn a lower multiple. What determines the discount rate? First, it is a function of perceived risk. A riskier stock earns a higher discount rate, which in turn earns a lower multiple. Second, it is a function of inflation or interest rates , arguably. Higher inflation earns a higher discount rate, which earns a lower multiple meaning the future earnings are worth less in inflationary environments.

Technical Factors Things would be easier if only fundamental factors set stock prices! Technical factors are the mix of external conditions that alter the supply of and demand for a company's stock.

Some of these indirectly affect fundamentals. For example, economic growth indirectly contributes to earnings growth. Technical factors include the following:. Market Sentiment Market sentiment refers to the psychology of market participants, individually and collectively.

This is perhaps the most vexing category because we know it matters critically, but we are only beginning to understand it. Market sentiment is often subjective, biased and obstinate.

For example, you can make a solid judgment about a stock's future growth prospects, and the future may even confirm your projections, but in the meantime the market may myopically dwell on a single piece of news that keeps the stock artificially high or low. And you can sometimes wait a long time in the hope that other investors will notice the fundamentals.

For related reading, see Investors Intelligence Sentiment Index. Market sentiment is being explored by the relatively new field of behavioral finance. It starts with the assumption that markets are apparently not efficient much of the time, and this inefficiency can be explained by psychology and other social sciences.

The idea of applying social science to finance was fully legitimized when Daniel Kahneman , a psychologist, won the Nobel Memorial Prize in Economics. He was the first psychologist to do so. Many of the ideas in behavioral finance confirm observable suspicions: Some investors claim to be able to capitalize on the theory of behavioral finance. For the majority, however, the field is new enough to serve as the "catch-all" category, where everything we cannot explain is deposited.

Summary Different types of investors depend on different factors. Short-term investors and traders tend to incorporate and may even prioritize technical factors.

Long-term investors prioritize fundamentals and recognize that technical factors play an important role. Investors who believe strongly in fundamentals can reconcile themselves to technical forces with the following popular argument: In the meantime, we can expect more exciting developments in the area of behavioral finance since traditional financial theories cannot seem to explain everything that happens in the market.

For a recap on the equities market, visit Equities Markets at Forbes. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Forces That Move Stock Prices By David Harper Share.

Factors That Affect the Stock Market | Finance - Zacks

In summary, the key fundamental factors are: The level of the earnings base represented by measures such as EPS, cash flow per share , dividends per share The expected growth in the earnings base The discount rate, which is itself a function of inflation The perceived risk of the stock.

Technical factors include the following: Inflation - We mentioned inflation as an input into the valuation multiple, but inflation is a huge driver from a technical perspective as well.

Historically, low inflation has had a strong inverse correlation with valuations low inflation drives high multiples and high inflation drives low multiples. Deflation , on the other hand, is generally bad for stocks because it signifies a loss in pricing power for companies.

To learn more, read All About Inflation.

Stock Markets - Dogpile Web Search

Economic Strength of Market and Peers - Company stocks tend to track with the market and with their sector or industry peers. Some prominent investment firms argue that the combination of overall market and sector movements - as opposed to a company's individual performance - determines a majority of a stock's movement. For example, a suddenly negative outlook for one retail stock often hurts other retail stocks as "guilt by association" drags down demand for the whole sector.

Substitutes - Companies compete for investment dollars with other asset classes on a global stage. These include corporate bonds , government bonds, commodities , real estate and foreign equities.

The relation between demand for U. Incidental Transactions - Incidental transactions are purchases or sales of a stock that are motivated by something other than belief in the intrinsic value of the stock. These transactions include executive insider transactions, which are often prescheduled or driven by portfolio objectives. Another example is an institution buying or shorting a stock to hedge some other investment.

Although these transactions may not represent official "votes cast" for or against the stock, they do impact supply and demand and therefore can move the price. Demographics - Some important research has been done about the demographics of investors. Much of it concerns these two dynamics: The hypothesis is that the greater the proportion of middle-aged investors among the investing population, the greater the demand for equities and the higher the valuation multiples. For more on this, see Demographic Trends And The Implications For Investment.

Trends - Often a stock simply moves according to a short-term trend. On the one hand, a stock that is moving up can gather momentum , as "success breeds success" and popularity buoys the stock higher. On the other hand, a stock sometimes behaves the opposite way in a trend and does what is called reverting to the mean.

Unfortunately, because trends cut both ways and are more obvious in hindsight, knowing that stocks are "trendy" does not help us predict the future. For more insight, check out Short-, Intermediate- and Long-Term Trends.

Liquidity - Liquidity is an important and sometimes under-appreciated factor. It refers to how much investor interest and attention a specific stock has.

Wal-Mart's stock is highly liquid and therefore highly responsive to material news ; the average small-cap company is less so. Trading volume is not only a proxy for liquidity, but it is also a function of corporate communications that is, the degree to which the company is getting attention from the investor community. Large-cap stocks have high liquidity: Many small-cap stocks suffer from an almost permanent "liquidity discount" because they simply are not on investors' radar screens.

To learn more, read Diving In To Financial Liquidity. Find out how to identify mispriced stocks. Learn about intrinsic and relative valuation methods based on fundamentals, and technical analysis. This method of valuing a company can make it look like a bargain when it is not.

Don't let the name fool you. Even a "fundamental" investor has to pay attention to certain metrics. Making money in the stock market has been likened to gambling by some, but experienced investors who do their homework usually profit by doing market analysis.

However, even experienced investors There are a few key indicators that fundamental investors should know. Why have stocks historically produced higher returns than bonds?

It's all a matter of risk. Without a doubt, common stocks are one of the greatest tools ever invented for building wealth. Learn how fundamental analysts use valuation measures, such as the price-to-earnings ratio, to identify when a growth stock A company's stock price will factor in many different variables including the type of industry the firm Learn about the differences between technical analysis and fundamental analysis, such as how these investment strategies An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.