Accounting stock options 123r

If you are a particularly diligent investor or a serious financial newshound, you may have heard of FAS R. For those of you who don't know about it, FAS R is the financial accounting standard introduced by the Financial Accounting Standards Board FASB that requires companies to deduct the amount of share-based equity payment granted to their employees on an annual basis.

Here we look at why this accounting standard has come about, what it involves and how it may affect you. Personal Income Tax Guide. Why Introduce this Rule? Many employees receive equity compensation as a supplement to their salaries.

Summary of Statement No. (revised )

Traditionally, this compensation comes in the form of stock option grants, which can be exchanged for shares of the company's stock. The basic idea behind FAS R is that the costs associated with equity payment for employee services are to be expensed on financial statements in order to reflect the economic transaction taking place between a company and its employees.

For further reading, see Show And Tell: The Importance Of Transparency. Equity compensation was not expensed previously because it is not a real monetary expense to a company. However, equity compensation is a direct expense to a company's shareholders. Shareholders are the owners of publicly-traded companies and, therefore, they are the ones who ultimately pay for the issue of extra shares through dilution.

When additional shares are issued by a company or convertible securities are converted, dilution occurs. If there were 10 shares in a given company, issuing five more shares for equity compensation would mean that the previous owners of the 10 shares would see their stake in the company reduced to only two-thirds.

To learn more, see The "True" Cost Of Stock Options. How it Affects You Why should this matter to you as an investor? Well, if you have a lot of money tied up in stocks, FAS R has the potential to take a substantial bite out of your portfolio's value.

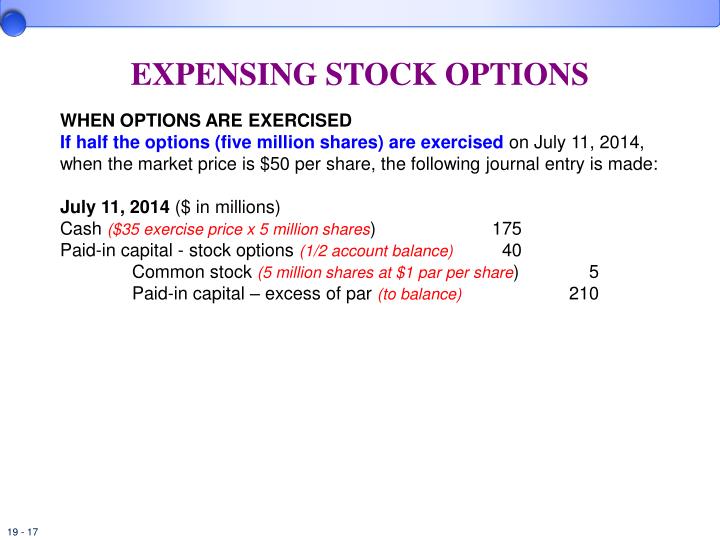

In the past, a company that issued stock options to its employees did not have to expense those options; for example, a grant of , options to an executive would cost the company nothing on paper.

Now, the FASB requires companies to charge the option grant multiplied by the fair value of the grant. As you can see, this new way of doing things could greatly affect the profitability of some companies. If you have many companies in your portfolio that rely on options to keep their executives happy, you should be aware that the stocks of these companies may be on their way to a price correction based on the news that their earnings have decreased substantially as a result of options expensing.

Arguments For and Against Opponents of employee stock option ESO expensing say that option grants help companies attract and motivate key employees and that they align shareholder interests i.

They also argue that if companies are required to expense options, they will likely use other forms of compensation instead - ones that do not align the goals of shareholders with those of grantees.

These proponents of the new rules maintain that if salary is expensed as an exchange for employee services, then it follows that equity-based compensation for the same employee services should also be expensed.

Even though FAS R puts stock-based compensation expenses on companies' balance sheets , the people who receive the most stock options will likely keep seeing the same levels of compensation they have always seen.

The question now is this: Executive compensation experts and securities lawyers are frantically seeking ways to resolve this conundrum. In the face of FAS R, equity compensation has changed - options are no longer the preferred means of rewarding executives, and new ways to reward good corporate performance have emerged.

Some of these, such as reload options , have been dug up from the s - the heyday of bull market fever and ESO granting.

FAS (Revised ) (as issued)

From the point of view of the investor, these new vehicles for compensation are not only intimidating and complicated, but hard to value, especially considering that the FASB has yet to come out with explicit guidelines for , and continues to indicate that it may alter R further.

The future of equity compensation is probably a derivative that has not yet been engineered. Before FAS R, options did not explicitly take away from a company's balance sheet earnings; so, despite their flaws, they were inherently more attractive than other compensation vehicles.

Now, granting common stock, stock appreciation rights SARs , dividends, options, or other derivatives of stock-based incentives are all equally expensive approaches to employee compensation, making the best incentives the ones that have the most motivational power.

From the investor's standpoint, equity compensation should not unduly dilute shareholders' ownership, should pay executives for market capitalization appreciation instead of stock price appreciation which can be easily manipulated by using share buybacks , and should be simple enough to dissect without having to spend days plowing through the legalese of a mandatory filing. From the executive's standpoint, equity compensation should be highly levered to provide exponentially high compensation for exceptional performance, and it should not expose them to potentially punitive income taxes.

Conclusion Whatever the future brings, expect some market correction of share prices as a result of the new FAS R option expensing regulations before a magic new derivative takes the place of good old stock options. Because FAS R is a change in financial reporting requirements, its implementation will change the bottom line profitability of many companies.

If you have a portfolio of stocks, you would be well advised to look ahead to see if this new reporting requirement will have a material effect on the reported financial performance of the companies in your portfolio. For further reading, see Option Compensation - Part One and Option Compensation - Part Two.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

A New Approach To Equity Compensation By Investopedia Share. Personal Income Tax Guide Why Introduce this Rule? The pros and cons of corporate stock options have been debated since the incentive was created. Learn more about stock option basics and the cost of stock options. Examine stock-based compensation among large tech firms to determine which factors are driving equity compensation and how executive grants are determined.

See what areas of finance were most likely to get you a bonus last year.

In , Senators Carl Levin and John McCain introduced a bill to stop the excessive deductions for ESOs. But is there another solution? Make sure you and your financial planner know how to get the most out of your equity compensation. Make sure you assess whether a CEO has a stake in doing a good job for you, the shareholder. Perhaps the real cost of employee stock options is already accounted for in the expense of buyback programs. There has been much debate over whether companies should treat employee stocks options as an expense.

This article examines both sides of the argument.

It is common for publicly-traded corporations to provide more than just regular salary compensation to their management and Learn how the SEC and IRS regulate employee stock options, including the exercise of options and the sale of options, and Restricted stock represents any equity that is conditionally given or sold to an insider as compensation or as part of an Options backdating occurs when companies grant options to their executives that correspond to a day where there was a significantly An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Stock Option Expensing | FAS R Reporting | Lipis Consulting

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.