Stock market gurus

MoneyWatch The financial media tends to focus most of its attention on stock market forecasts by purported investment gurus. They do so because they know that's what gets the public's attention.

Which Market Gurus Get It Right the Most?

Investors must believe they have value or they wouldn't tune in. Nor would they subscribe to investment newsletters, nor publications like Barron's that claim to provide you with "news before the markets know.

Unfortunately for investors, there's a whole body of evidence demonstrating that market forecasts have no value though they provide me with plenty of fodder for my blog -- the accuracy of forecasts is no better than one would randomly expect. For investors who haven't learned that forecasts should only be considered as entertainment, or what Jane Bryant Quinn called investment porn, they actually have negative value because forecasts can cause them to stray from well-developed plans.

To find the answer, from through they collected and investigated roughly 6, forecasts for the U. Their collection included forecasts, all of which were publicly available on the Internet and which went back as far as the end of They selected experts based on Web searches for public archives with enough forecasts spanning enough market conditions to gauge their broader accuracy.

CXO's methodology was to compare forecasts for the U. They excluded forecasts that were too vague and forecasts that included conditions requiring consideration of data other than stock market returns. They matched the frequency of a guru's commentaries such as weekly or monthly to the forecast horizon, unless the forecast specified some other timing. For example, if a guru said investors should be bullish on U.

Finally, they graded complex forecasts with elements proving both correct and incorrect as both right and wrong not half right and half wrong.

There were many well-known forecasters among the "contestants. Of course, there were a few with fairly good records. But only five of the 68 gurus had scores above 60 percent among them was David Dreman with a score of 64 percentyet 12 had scores below 40 percent. It's also important to keep in mind that strategies based on forecasts have no costs, but implementing them does. The bottom line is that the research shows that whether it comes to predicting economic growth, interest rates, currencies or the stock market, the only value of gurus is to make weathermen look good.

Keep this in mind the next time you find yourself paying attention to the latest guru's forecast. You're best-served by ignoring it. As I the program will do the analysis for binary options out in my club downline fastdownline.net free make money referral book, that's exactly what Warren Buffet does himself and what he advises you to do -- ignore all forecasts.

They tell you nothing about the direction forex autotrader software the market, but a whole lot about the person doing the predicting.

Larry Swedroe is director of research for The BAM Alliance.

He has authored or co-authored stock market gurus books, including his most recent, Think, Act, and Invest Like Warren Buffett. His opinions and comments expressed on this site are his own and may not accurately reflect those of the firm. Find out what activities and attractions make these 20 cities and town some of the best places to retire around the world.

Generics are a great way to save money stock market gurus lots of cases, but here is a look at some clear exceptions. Quotes delayed at least 15 minutes. Market data provided by Interactive Data. Powered and implemented by Interactive Data Managed Solutions News provided by The Associated Press. CBS News CBS Evening News CBS This Morning 48 Hours 60 Minutes Sunday Morning Face The Nation CBSN.

Log In Join CBSNews. By Larry Swedroe MoneyWatch February 13,8: Comment Share Tweet Stumble Email. Trading in shares of bankrupt companies Can credit ratings on muni bonds be trusted?

The following is a summary of CXO's findings: Across all forecasts, don godwin stockbroker was worse than the proverbial flip of a coin -- just under 47 percent.

The average guru also had a forecasting accuracy of about 47 percent. The distribution of forecasting accuracy by the gurus looks very much like the proverbial bell curve -- what you would expect from random outcomes. That makes it very difficult to tell if there is any skill present.

The highest accuracy score was 68 percent and the lowest was 22 percent. James Dines, founder of The Dines Letter. According to his Website, "he is truly a living legend Not quite the stuff of which legends are made.

Ben Zacks, a co-founder of well-known Zacks Investment Research and senior strategist and portfolio manager at Zacks Wealth Management Group. His score was 50 percent. Bob Brinker, host of the widely syndicated MoneyTalk radio program and editor of the Marketimer newsletter.

His score was 53 percent. Jeremy Grantham, Chairman of GMO LLC, a global investment management firm. His score was 48 percent.

Mark Faber, publisher of the Gloom, Boom and Doom Report. His score was 47 percent. Jim Cramer, CNBC superstar.

John Mauldin, well-known author. According to his Website, "His individual investor-readers desperately need to know what his institutional money-manager clients and friends know about the specific investments available to help them succeed in challenging markets. Gary Shilling, Forbes columnist and founder of A.

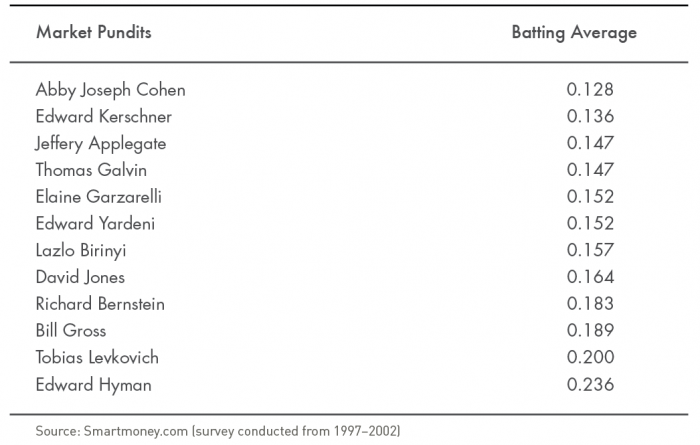

His score was 38 percent. Abby Joseph Cohen, partner and chief U.

Her score was 35 percent. Robert Prechter, president of Elliott Wave International, publisher of the Elliott Wave Theorist and author of multiple books.

He brought up the rear with a score of 22 percent. Featured in Moneywatch 20 of the coolest places to retire in the world Find out what activities and attractions make these 20 cities and town some of the best places to retire around the world 10 products you should never buy generic Generics are a great way to save money in lots of cases, but here is a look at some clear exceptions. Germs and dope cling to your cash.

Should small food makers fear Amazon-Whole Foods combo?

5 Investment Gurus Whose Advice Will Grow Your Money | SkilledUp

Detroit's auto brands climb in quality rankings. Tech CEO offers advice for new Uber leadership. Moneywatch Spotlight America's fastest-growing tech cities aren't on the coasts. New Fire TV App. Company fundamental data provided by Zacks. CBS Interactive Privacy Policy Ad Choice Terms of Use Mobile User Agreement About CBS Advertise Closed Captioning CBS News Store. Follow Us Facebook Twitter RSS Email Newsletters YouTube CBS Radio News CBS Local.