Ppt stock market manipulation definition

Money Market Hedge. Money Management | gepahotalefi.web.fc2.com

The Working Group on Financial Markets, also know as the Plunge Protection Team, was created by Ronald Reagan to prevent a repeat of the Wall Street meltdown of October Its members include the Secretary of the Treasury, the Chairman of the Federal Reserve, the Chairman of the SEC and the Chairman of the Commodity Futures Trading Commission. Recently, the team has been on high-alert given the increased volatility of the markets and, what Hank Paulson calls, "the systemic risk posed by hedge funds and derivatives.

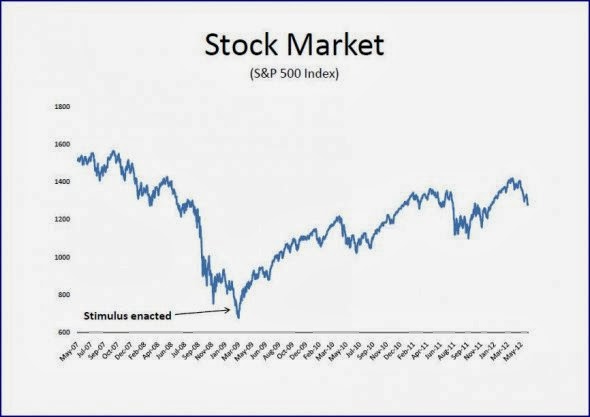

US manufacturing is already in recession, the dollar continues to weaken, consumer spending is flat, and the sub-prime market in real estate has begun to nosedive. These have all contributed to the markets' erratic behavior and created the likelihood that the Plunge Protection Team may be stealthily intervening behind the scenes. According to John Crudele of the New York Post, the Plunge Protection Team's PPT modus operandi was revealed by a former member of the Federal Reserve Board, Robert Heller.

Former-Clinton advisor, George Stephanopoulos, verified the existence of The Plunge Protection Team as well as its methods in an appearance on Good Morning America on Sept 17, They have in the past acted more formally… I don't know if you remember but in , there was a crisis called the Long term Capital Crisis.

It was a major currency trader and there was a global currency crisis. And they, with the guidance of the Fed, all of the banks got together when it started to collapse and propped up the currency markets. And, they have plans in place to consider that if the markets start to fall.

In fact, as Ambrose Evans-Pritchard of the U. The editors of the New York Times summarized the feelings of many market-watchers who were baffled by this odd recovery: Manufacturing has already slipped into a recession, with activity contracting in two of the last three months.

How is it then that investors took Mr. McHugh lays it out like this: To get that rally, the PPT's key component — the Fed — lends money to surrogates who will take that fresh electronically printed cash and buy markets through some large unknown buyer's account. That buying comes out of the blue at a time when short interest is high.

The unexpected rally strikes blood, and fear overcomes those who were betting the market would drop. These shorts need to cover, need to buy the very stocks they had agreed to sell without owning them at today's prices in anticipation they could buy them in the future at much lower prices and pocket the difference. Seeing those stocks rally above their committed selling price, the shorts are forced to buy — and buy they do.

Thus, those most pessimistic about the equity market end up buying equities like mad, fueling the rally that the PPT started. Bingo, a huge turnaround rally is well underway, and sidelines money from Hedge Funds, Mutual funds and individuals' rushes in to join in the buying madness for several days and weeks as the rally gathers a life of its own. More importantly, outside intervention punishes the people who see the weaknesses in the stock market and have invested accordingly.

Clearly, these people are being ripped off by the PPT's back-channel manipulations. They deserve to be fairly compensated for the risks they have taken. Moreover, artificially propping up the market only encourages over-leveraged speculators and smiley-face Pollyanna's who continue to believe that the grossly-inflated market will continue to rise.

Rewarding foolishness only stimulates greater speculation. The tinkering of the PPT is sure to erode confidence in the unimpeded activity of capital markets. The actions of the Plunge Protection Team prove that it's all baloney. It's their system and they're not going to let it get wiped out by some silly commitment to principle.

The Plunge Protection Team may wrap itself in pompous rhetoric, but it operates like a Fiscal Politburo inserting itself into the market in way that promotes the narrow interests of its own constituents.

Besides, the market is so fragile it trembles every time someone halfway around the world sells a fistful of equities. It needs a good shakedown. The years of deregulation have taken their toll.

The market is resting on a foundation of pure quicksand. Collateralized debt, rickety hedge funds, shaky sub-prime equities, and an ocean of margin debt are just a few examples of deregulation's excesses.

These untested debt-instruments are presently bearing down on Wall Street like a laser-guided missile. Wall Street needs to regain its lost credibility with more regulation and stricter laws. The system needs a major face-lift. Still, even as the markets rumble and shake, Paulson rejects any move towards greater government supervision. According to the New York Times: That stance is mostly free-market ideology run amok.

But it is also based on the unproven assumption that unregulated investing, which dispersed risk and reduced volatility as markets surged, will continue to do so when markets tank.

The upshot is a one-sided bet for investors. They have explicit assurances from regulators and policy makers that almost anything goes when the markets are hot, and implicit assurances — based on past experience — that the Fed would lower interest rates to contain a financial crisis should one erupt.

Unfortunately, there is no guarantee that easing up on rates would have the same powerful effect in a future crisis as it had in the past. The next crisis appears to be building around weakness in the United States, not in Russia or Asia or South America. That means money could flow out of the country if markets were rattled. That would weaken the dollar and require speedy and complex remedial action by the world's central banks — not just a rate cut by the Fed.

A meltdown in the Hedge funds industry or the derivatives market would bring the entire economy crashing to earth. Paulson's Plunge Protection Team is a band-aid approach to a much more serious dilemma.

It's time for the government to get involved and protect the small investor. Paulson has shown that he understands the problem; he simply resists the solution. Do we have enough liquidity in the system"?

But it won't work. This is the biggest equity bubble in history. Neither increasing the money supply nor lowering interest rates will fend off the impending catastrophe. We need to address the mushrooming risk that has arisen from lending hundreds of billions in sub-prime loans, and from overexposure in the hedge funds and derivatives markets.

The Silver Bear Cafe - Financial Markets

The world's markets are facing a global liquidity crisis which will become more evident as the real estate sub-prime market continues to deteriorate. This will undoubtedly be accompanied by larger and more ferocious gyrations in the stock market. It's All Uphill from Here on Out The U. The ostensible reason is to lure back hedge funds from London, but it is odd policy to license extra leverage just as the Dow hits an all-time high and the VIX 'fear' index nears an all-time low — signaling a worrying level of risk appetite.

The normal practice across the world is to tighten margins to cool over-heated asset markets. The stewards of the system are actively seeking larger infusions of marginal debt just to keep the faltering market on its last legs. That's not reassuring and it is clearly a step in the wrong direction.

It further illustrates the worrisome level of recklessness at the top rungs of the decision-making apparatus. This seems like a reasonable way to address the prospect of a major economic collapse following a terrorist attack or a natural disaster.

However, the systemic weakness in the market and the great uncertainty surrounding hedge funds and derivatives suggests that the PPL is probably being used to stabilize an over-leveraged and thoroughly-debauched system. If that's the case, then we need to know whether the PPT really operates in the public interest or if it is just a stopgap for big business to avoid a painful retrenchment?

It's the corporate warlords and banking moguls who have benefited the most from dismantling the regulatory system. There's no reason why the market should be manipulated simply to protect private investment. It is a fundamental contradiction to the workings of a free market.

According to Michael Edward: In all 3 instances, when the markets opened all the indexes began to quickly plunge. In each incidence, by early afternoon the markets were brought back from the brink of collapse to the surprise of everyone, including historical analysts…. An event that should have sent markets spiraling downward was the Enron, et al, unprecedented corporate accounting scandals.

Yet despite this, an unprecedented across-the-board markets rally began on July 24, He cites an article in the UK Guardian on which states, "that a secretive committee The Fed, supported by the banks, will buy equities from mutual funds and other institutional sellers. Whenever the stock market was in trouble someone seemed to ride to the rescue. This may explain why the Federal Reserve mysteriously decided to stop publishing its M-3 report. So by abolishing the M-3, the Federal Reserve has removed its greasy fingerprints from the smoking gun of market meddling?

Also, by what authority do the government and the privately-owned banks interfere in the futures' markets and shift momentum from the prevailing trend? Is this a free market or a command economy? The precariousness of our present economic situation has caused these dramatic changes and strengthened the conjugal relationship between the privately-owned Central Bank, major corporations and the state.

The market is more vulnerable now than anytime since the late s, a fact that was emphasized in a statement by the IMF just 2 months ago: It is clear that risks are on the downside of a sharper than expected slowdown in house prices that would produce weaker-than-expected growth that would have implications for global growth and financial markets.

The possibility of a major disruption grows more likely by the day. Easy money almost everywhere leads to leverage and speculation. No where is this more prevalent than in the global derivatives market. It is not out of the question that third party defaults and risk aversion designed instruments that collapse and go sour may someday overwhelm the financial markets. Latest figures from the Bank of International Settlements: That's 38 to 1 leverage.

If there's a fire-sale in hedge funds or derivatives, there's nothing the Plunge Protection Team or the Federal Reserve will be able to do to stop a meltdown. The market will crash leaving nothing behind.

We are reaping the rewards of a lawless, deregulated system which has removed all the safeguards for protecting the small investor. There is no government oversight; it's a joke. The stock market is a crap-shoot that serves the sole interests of establishment elites, corporate plutocrats, and banking giants. The small investor is trapped beneath the wheel and getting squeezed more and more every day. He has no way to fix the markets like the big guys and no lobby to promote his interests.

He must arrive at his decisions by researching publicly available information and then plunking down his money. He'd be better off in a casino; the odds are about the same. Mike is a well respected freelance writer living in Washington state, interested in politics and economics from a libertarian perspective. The 'big funds', especially Fidelity, know exactly who's in the market and what positions they have.

Everything is computerized besides the selling and buying of a stock is done internally - the manipulators sell and buy instantaneously, though their own accounts but in different names.

So, beware what you're getting into if you are a daytrader. Especially beware of trading with 'Fidelity'. They are the biggest MF's 1st M stands for Mother I know in this game. Terms of Use Privacy Policy. UK General Election Forecast: Theresa May to Resign, Fatal Error Was to Believe Worthless Opinion Polls! The Stock Market Crash of That Never Was But Could it Still Come to Pass?

The Aftermath - 20th Jun 17 Why Walkers Crisps Pay Packet Promotion is RUBBISH! The Billion Dollar Tech Boom No One Is Talking About - 19th Jun 17 Amey Playing Cat and Mouse Game with Sheffield Residents and Tree Campaigners - 19th Jun 17 Positive Stock Market Expectations, But Will Uptrend Continue? Grenfell Cladding Fire Disaster! Forecast - 13th Jun 17 Gold and Silver at Breakout Point from 6-Year Downtrend - David Morgan Exclusive - 13th Jun 17 Goldman Sachs Crashes Tech FANG Stocks!

Market Oracle FREE Newsletter. Only logged in users are allowed to post comments. Any and all information provided within the web-site, is for general information purposes only and Market Oracle Ltd do not warrant the accuracy, timeliness or suitability of any information provided on this site.

We do not give investment advice and our comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to enter into a market position either stock, option, futures contract, bonds, commodity or any other financial instrument at any time.

We recommend that independent professional advice is obtained before you make any investment or trading decisions. By using this site you agree to this sites Terms of Use. In return for that endorsement and only in the cases where you purchase directly though us may we be compensated by the producers of those products. Home Free Newsletter RSS Feed Help FAQ Terms of Use Privacy Policy Submit Articles Advertising About Us. Inflation is No Longer in Stealth Mode - 21st Jun Crude Oil Verifies Price Breakdown — Or Is It Something More?

Trump Backs ISIS As He Pushes US Onto Brink of World War III With Russia - 20th Jun Most Popular Auto Trading Tools for trading with Stock Markets - 20th Jun GDXJ Gold Stocks Massacre: The Aftermath - 20th Jun Why Walkers Crisps Pay Packet Promotion is RUBBISH!

US Bonds and Related Market Indicators - 19th Jun The Billion Dollar Tech Boom No One Is Talking About - 19th Jun Amey Playing Cat and Mouse Game with Sheffield Residents and Tree Campaigners - 19th Jun Positive Stock Market Expectations, But Will Uptrend Continue? Gold Proprietary Cycle Indicator Remains Down - 19th Jun Stock Market Higher Highs Still Likely - 18th Jun The US Government Clamps Down on Ability of Americans To Purchase Bitcoin - 18th Jun Return of the Gold Bear?

Are Sheffield's High Rise Tower Blocks Safe? Globalist Takeover Of The Internet Moves Into Overdrive - 17th Jun Crazy Charging Stocks Bull Market Random Thoughts - 17th Jun Reflation, Deflation and Gold - 17th Jun Gold Bullish on Fed Interest Rate Hike - 16th Jun Drones Upending Business Models and Reshaping Industry Landscapes - 16th Jun Grenfell Tower Cladding Fire Disaster, 4, Ticking Time Bombs, Sheffield Council Flats Panic!

Heating Oil Bottom Is In. The War On Cash Is Now Becoming The War On Cryptocurrency - 15th Jun The US Dollar Bull Case - 15th Jun The Pros and Cons of Bitcoin and Blockchain - 15th Jun The Retail Sector Downfall We Saw Coming - 15th Jun Charts That Explain Why The US Rule Oil Prices Not OPEC - 15th Jun How to Find the Best Auto Loan - 15th Jun Ultra-low Stock Market Volatility ThisTimeIsDifferent - 14th Jun DOLLAR has recently damaged GOLD and SILVER- viewed in MRI 3D charts - 14th Jun US Dollar Acceleration Phase is Dead Ahead!

Rise Gold to Recommence Work at Idaho Maryland Mine After 60 Years - 14th Jun Stock Market Tech Shakeout! The 1 Gold Stock of - 14th Jun How One Forecasting Tool Defied the Stocks Bull Market Naysayers - 13th Jun When Will Theresa May 'Dead Woman Walking' Resign?

Forecast - 13th Jun Gold and Silver at Breakout Point from 6-Year Downtrend - David Morgan Exclusive - 13th Jun Goldman Sachs Crashes Tech FANG Stocks! UK General Election Results Map vs vs Opinion Polls - 13th Jun 17 -. The Disturbing Trend That Will End in a Full-Fledged Pension Crisis - 12th Jun US-China Ties in the Shadow of the Mueller Investigation - 12th Jun How The Smart Money Is Playing The Lithium Boom - 12th Jun Brian OH 16 Jan 08, Market Manipulation I agree entirely that market manipulation by US authorities is morally wrong.

As you say, they pay lip service to free markets. I guess if there is anything there we will never find out.

It is time in my opinion for a class action suit against US authorities PPT for manipulating what is ostensibly a free market. When PE ratios get too high it is time for a correction.

The Fed preaches that, but acts differently.