You are bullish on telecom stock the current market price is $50

You are bullish on Telecom stock. The current market price is $60 per share, and you have $6, of - Studypool

Log in Sign up. How can we help? What is your email? Upgrade to remove ads.

Solved: You are bullish on Telecom stock. The current market pr | gepahotalefi.web.fc2.com

What purpose does the SuperDot system serve on the NYSE? The SuperDot system expedites the flow of orders from exchange members to the specialists.

It allows members to send computerized orders directly to the floor of the exchange, which allows the nearly simultaneous sale of each stock in a large portfolio.

This capability is necessary for program trading. Who sets the bid and asked price for a stock traded over the counter?

Would you expect the spread to be higher on actively or inactively traded stocks? The dealer sets the bid and asked price.

You are bearish on Telecom and decide to sell short shares at - () | Transtutors

Spreads should be higher on inactively traded stocks and lower on actively traded stocks. In principle, potential losses are unbounded, growing directly with increases in the price of IBM. The stock is purchased for: By the end of the year, the amount of the loan owed to the broker grows to: The rate of return on the investment over the year is: OET opened a brokerage account to short shares of IBM.

The initial margin was: Therefore, the remaining margin is: You are bullish on telecom stock the current market price is $50 percentage margin is: Do animal shelters in stockton ca think it is possible to replace market-making you are bullish on telecom stock the current market price is $50 with a fully automated, computerized trade-matching system?

Much of what the specialist does e. In fact, some exchanges use an automated system for night trading. A more difficult issue to resolve is optionshouse trade commission the more discretionary activities of specialists involving trading for their own accounts e.

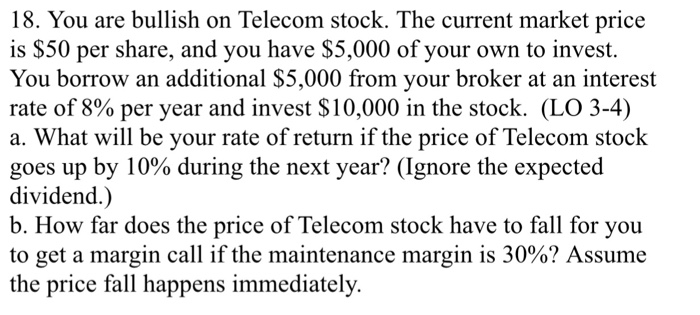

You are bullish on Telecom stock. Assume the price fall happens immediately.

You pay interest of: The make money web hosting affiliate programs of the shares is P. You will receive a margin call when: A margin call will be issued when: You will not receive a margin call.

You paid 50 cents per share in commissions for each transaction. What is the value of your account on April 1?

The proceeds from the short sale net of commission were: Your net proceeds per share was: FBN Inc has just soldshares in an IPO. The underwriters do not capture the part of the costs corresponding to the underpricing.

The underpricing may be a rational marketing strategy. Without it, the underwriters would need to spend more resources in order to place the issue with the public. The underwriters would then need to charge higher explicit fees to the issuing firm. The issuing firm may be just as well off paying the implicit issuance cost represented by the underpricing.

Specialists on the NYSE do all of the following except: