Premarket trading

The pre-market is the period of trading activity that occurs before the regular market session.

Pre-Market Trading - Learn About Extended Hours Stock Trading

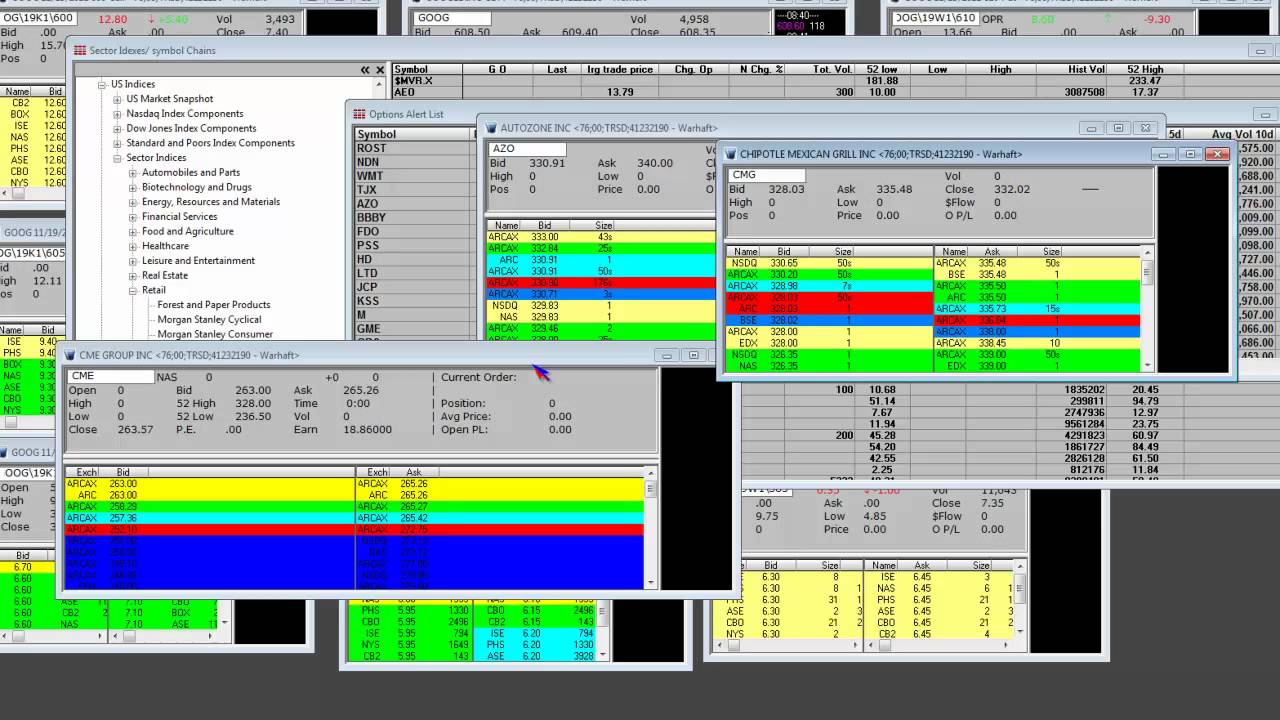

The pre-market trading session typically occurs between EST each trading day. Many investors and traders watch the pre-market trading activity to judge the strength and direction of the market in anticipation for the regular trading session.

Pre-market trading activity generally has limited volume and liquidity ; therefore, large bid-ask spreads are common. Many retail brokers offer pre-market trading but may limit the types of orders that can be used during the pre-market period. Several direct-access brokers allow access to pre-market trading to commence as early at 4 a.

Ep: 77 Trading During Pre-Market & After Hours SessionsEST from Monday through Friday. Interactive Brokers Group Inc. It is important to remember there is very little activity for most stocks so early in the morning unless there is news.

The liquidity is also extremely thin, with most stocks only showing stub quotes. Stocks such as Apple Inc.

Premarket Stock Trading - CNNMoney

Since the market is so thin before 8 a. EST, there is very little benefit to trading so early.

Premarket Trading financial definition of Premarket Trading

In fact, the slippage from exceptionally wide spreads makes it detrimental in most cases to trade. Most brokers begin pre-market access at 8 a. This is when the volume picks up simultaneously across the board, especially for stocks indicating a gap higher or lower based on news or rumors.

The pre-market indications for a stock can be especially tricky for traders and should only be interpreted lightly. Stocks can appear strong pre-market, only to reverse direction at the normal market open at 9: Only the most experienced traders should ever consider trading in the pre-market.

One advantage is the ability to get an early jump on reactions to news releases. However, the limited amount of volume can give the perception of strength or weakness that can be deceptive and false when the market opens as real volume comes into play.

Pre-market trading can only be executed with limit orders through electronic communication networks ECNs such as Archipelago ARCA , Instinet INCA , Island ISLD and Bloomberg Trade Book BTRD.

Market makers are not permitted to execute orders until the 9: Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

What is the 'Pre-Market' The pre-market is the period of trading activity that occurs before the regular market session.

Pre-Market Trading Since the market is so thin before 8 a. Extended Trading Nasdaq Pre-Market Indicator Opening Price Direct-Access Broker Overnight Position Closing Quote After-Hours Trading Night Cycle Volume Of Trade. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.