Vxx options strategies

Related Posts Volatility White Papers: VIX Option and Futures Expiration Dates. Are your Greeks correct for VIX options? Hey wow I really like your article because it explains everything in great detail.

Well but when I came across your blog I felt so much more confident because your article seems so simple and easy. Thanks a lot for sharing. You might also find this interesting — Top 6 Reasons to Trade Volatility http: To clarify in regards to exercising the options, once you go long a call, the only time you can get out of it is at expiration?

Hi Felix, You can always sell the call whenever the market is open, exercising is restricted to only happen at expiration. With American style options there is the ability to exercise early and there are sometimes times when it makes economic sense to do that, primarily associated with dividends, or possibly with mis-pricing. The underlying for the options IS is the vix index and the SOQ calculated based on the same SPX options that are used to calculate the VIX index also. The reason the options seem to track the futures and not the index, is the european style exercise — the options behave as they were american style options with the futures as the underlying, but they actually are european style options with the index as the underlying.

Hi Markus, I agree that VIX futures are not the actual underlying of VIX options and I have modifed the post to that effect. As you mention, the actual settlement uses the SOQ calculation on a set of SPX options.

These options form a 30 day forward log contract variance swap priced in volatility points. The reality is that VIX Futures act as if they were the underlying of the appropriate vix options series e.

Explaining everyday VIX option pricing with respect to VIX futures is straightforward—trying to explain it in terms of the VIX spot is impossible. Where Is The Stock Price Located — stockadvertise. For example, as I am typing this, calls for next month at the 15 strike are quoted at 1. If I joined the bid, what are the chances that someone hits me there…and if I placed a limit order at say 1. I understand its not an absolute science but any experience you could relay would be great.

Vance, I have been reading your blog for some time and I find it one of the most interesting source of information on volatility products. I hope your read the comments to older posts, because I have a question.

You mentioned often that the true underlying of VIX option is the corresponding future contract instead of the index itself; while I intuitively agree with you, I could not find any technical discussion of the point besides your considerations on put-call parity.

Access to this page has been denied.

Did I miss something? Is there anything I can read to get a better understanding of the issue? Since VIX options do not allow early exercise and are cash settled the whole concept of an underlying is not really necessary.

To be really technical, the pricing bedrock for VIX options and futures is a 30 day variance forward variance priced in volatility points. The square root of variance is volatility. Hi Vance, thanks for your prompt reply. I used to trade interest rate and equity derivatives actually, I was in charge of financial product engineering at a major Italian bank around 20 years ago, but I never had the opportunity to trade volatility products.

Thirteen Things You Should Know About Trading VIX options Updated: Your brokerage account needs to be a margin account, and you need to sign up for options trading.

Getting Long Volatility by Selling Puts in VXX

There are various levels of option trading available e. My experience is that to trade VIX options you will need to be authorized to trade at the second level. If you are just getting into options trading this is as high as you want to go anyway.

Selling naked calls for example, is not something for a rookie to try. No special permissions are required from your broker for VIX options. In general, the same sort of restrictions e. More on that later. The option greeks for VIX options e. Most options chains that brokers provide assume the VIX index is the underlying security for the options, in reality, the appropriate volatility future contract should be used as the underlying.

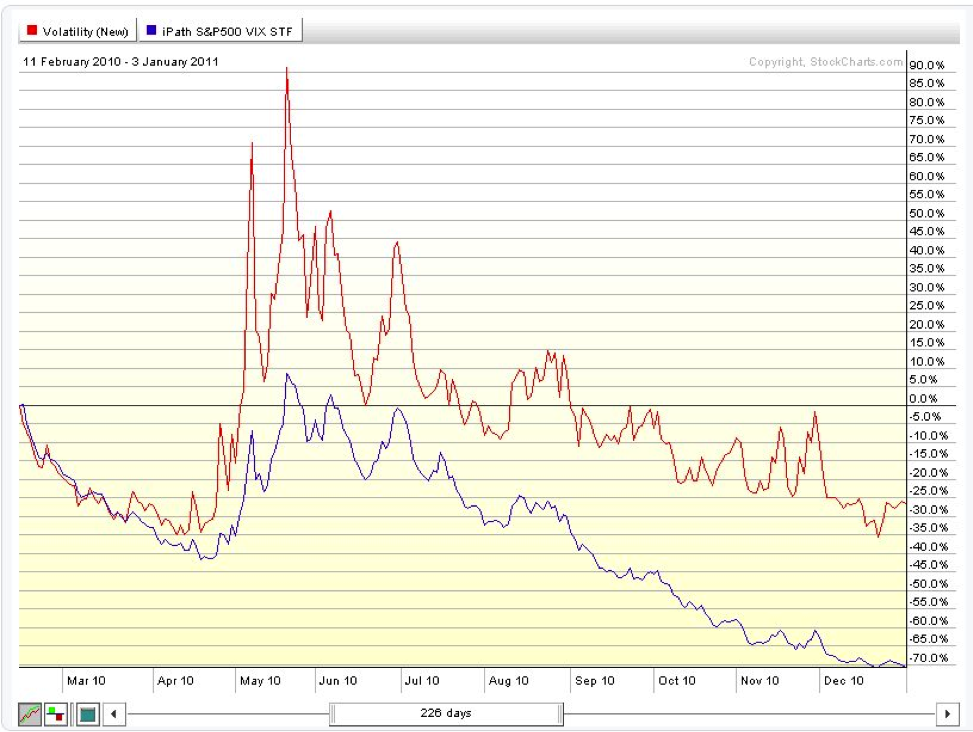

VXX Ratio Spread Backratio Option Strategy Best Trading systemTo compute reasonably accurate greeks yourself go to this post. While technically not the actual underlying, VIX futures act as if they were the underlying for VIX options—the options prices do not closely track the VIX.

A big VIX spike will be underrepresented, and likewise, a big drop probably will not be closely tracked. This is a huge deal. It is very frustrating to predict the behavior of the market, and not be able to cash in on it. The only time the VIX options and VIX are guaranteed to sort-of match is on the morning of expiration—and even then they can be different by a couple of percent.

The closer the VIX future and the associated VIX option are to expiration, the closer they will track the VIX. The following chart from the CBOE shows the typical relationship. The VIX options are European exercise.

There is no effective limit on how low or high the prices can go on the VIX options until the exercise day. Expiring In-the-Money VIX options give a cash payout. The payout is determined by the difference between the strike price and the VRO quotation on the expiration day. This is the expiration value, not the opening cash VIX on the Wednesday morning of expiration.

VIX options expire at market open on expiration day, so expiring options are not tradeable during regular hours on that day. VIX options do not expire on the same days as equity options.

Our Membership | Learn Stock Options Trading | option pricing

This odd timing is driven by the needs of a straightforward settlement process. On the expiration Wednesday the only SPX options used in the VIX calculation are the ones that expire in exactly 30 days.

For more on this process see Calculating the VIX—the easy part. The bid-ask spreads on VIX options tend to be wide. If you have time start halfway between the bid-ask and increment your way towards the more expensive side for you. If you are a newbie trade something sane like SPY options first… The VIX is not like a stock, it naturally declines from peaks. This means its IV will always decline over time. As a result VIX options will often have lower IVs for longer term options—not something you see often with equities.

The CBOE reports that trading hours are: The first VIX quote of the day is usually at least a minute after opening. That is good info.

Access to this page has been denied.

Thanks…that is seriously good to know…. I was wondering the same thing.. You sir have answered many of my questions with that single post. Thank you very much. All content on this site is provided for informational and entertainment purposes only, and is not intended for trading purposes or advice.

This site is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. It is not intended as advice to buy or sell any securities. I am not a registered investment adviser. Please do your own homework and accept full responsibility for any investment decisions you make.