Yield spread and stock market increase

The following is a reprint of the market commentary from the June edition of The Option Advisor , published on May For more information or to subscribe to The Option Advisor , click here.

Equity benchmarks around the world experienced a patch of bumpy price action in mid-May, as a sell-off in German bunds spilled over into U. Yields on both instruments jumped as prices fell, and rattled investors dumped stocks in a hurry.

Corporate bond yield spreads in recent decades: an examination of trends, changes, and stock market linkages.

Chances are, you're already familiar with this type of interplay between Treasury notes and stocks. When bond prices fall, yields rise -- which translates into increased borrowing costs.

Not only do higher yields diminish the appeal of investing in equities, they also raise the threat of constricted corporate spending. As a result, a sudden or unexpected rise in yields can trigger equally sudden weakness in stocks.

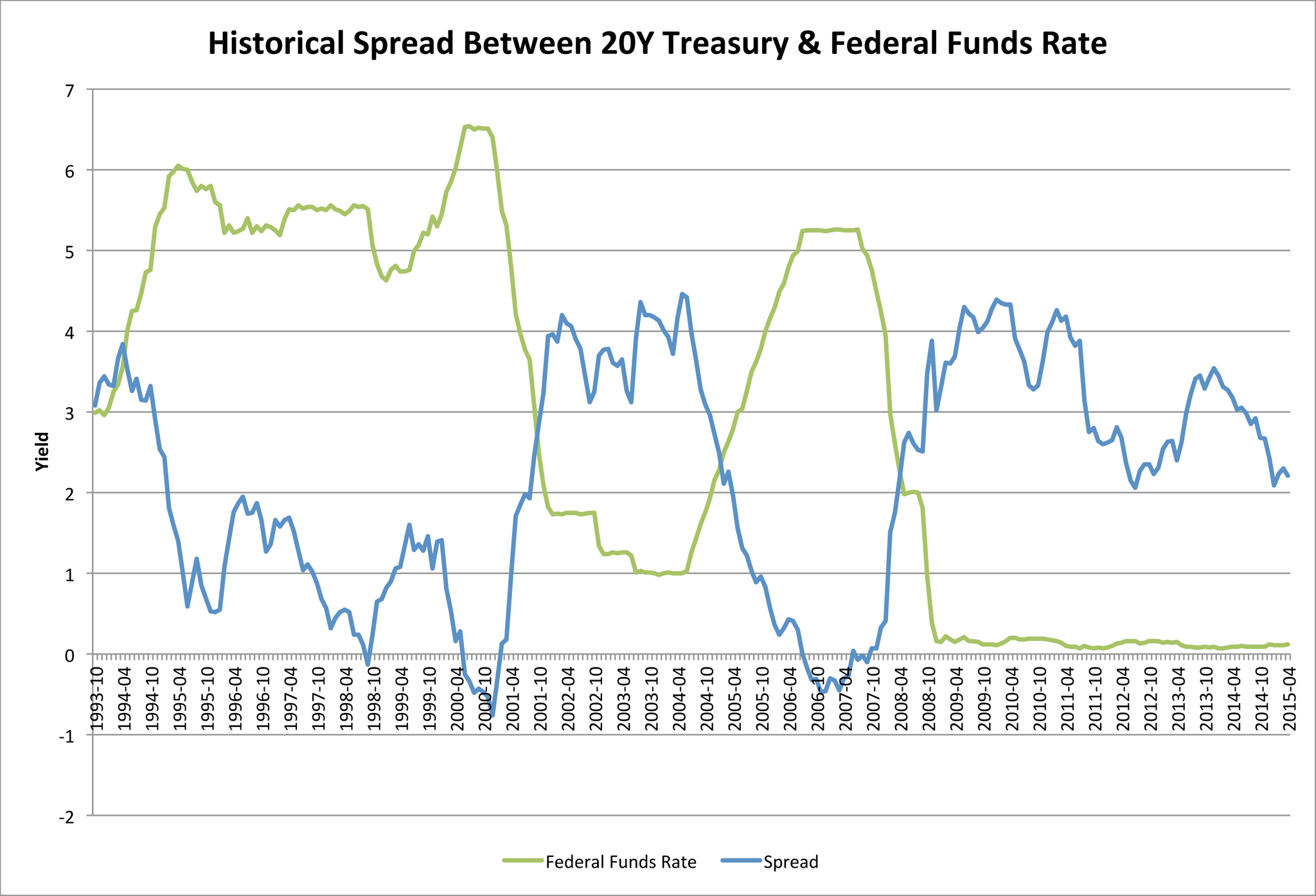

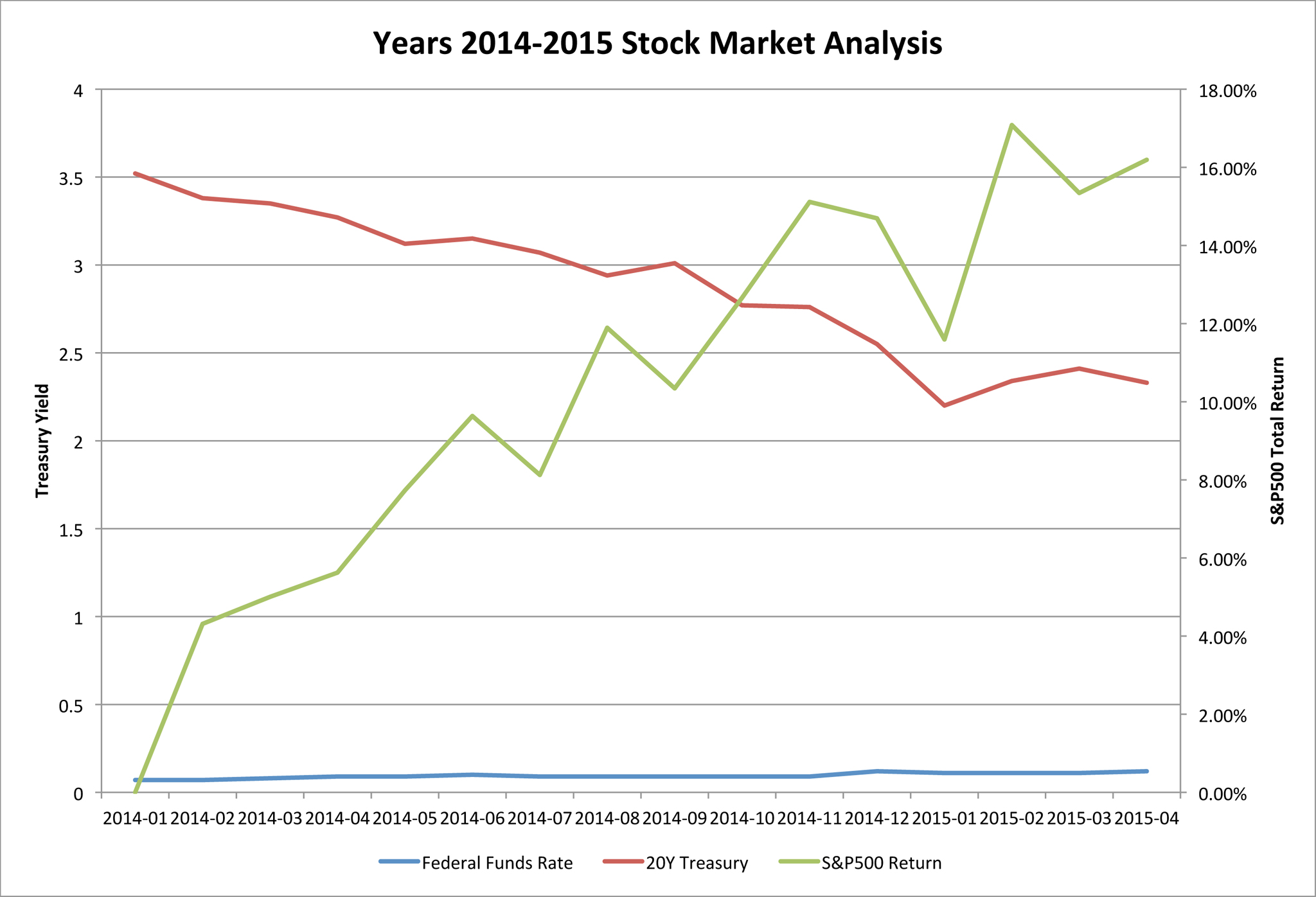

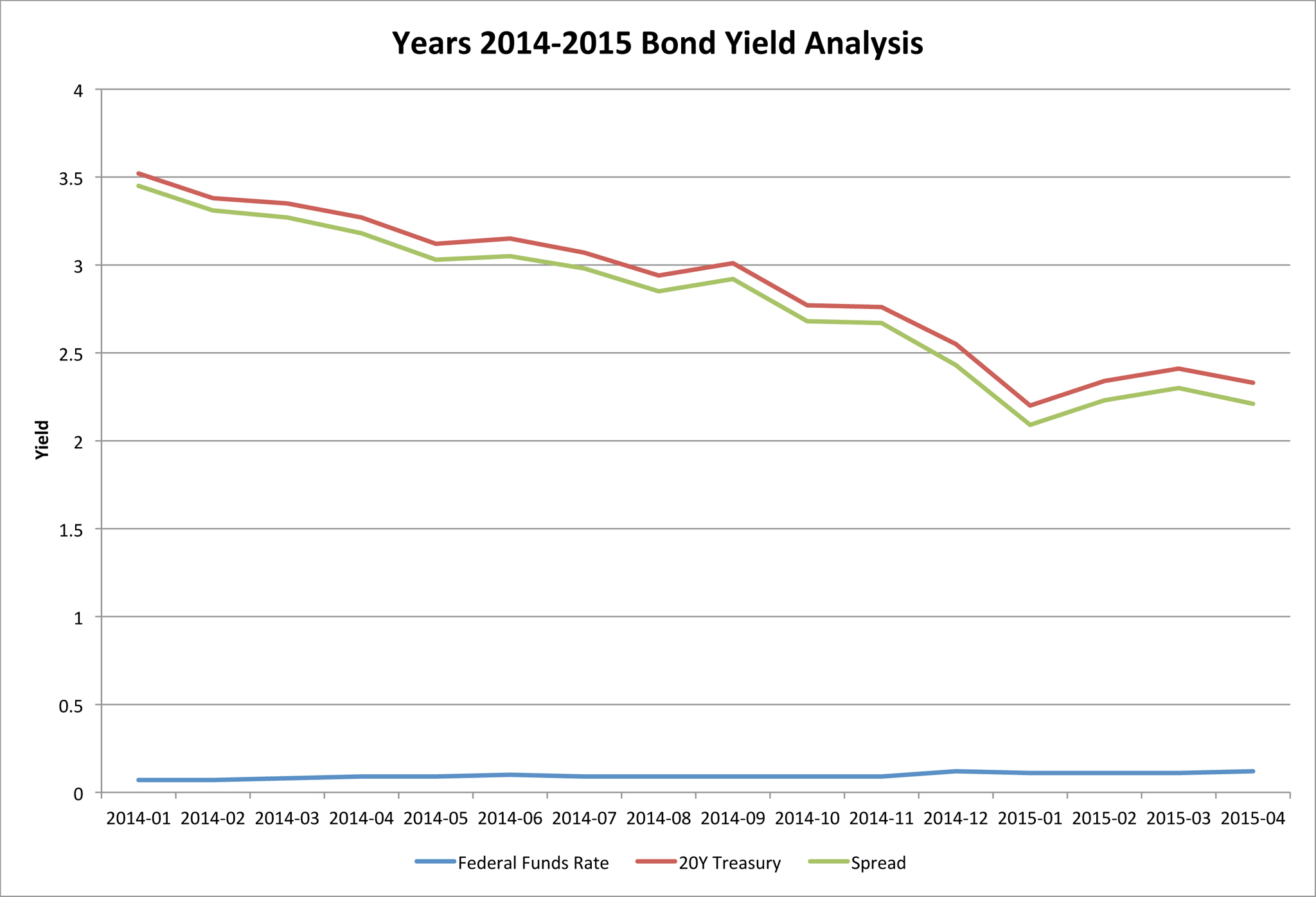

However, a deeper dive into the data suggests there may be more to this relationship than occasional short-lived, knee-jerk jolts. As the chart below clearly displays, the market crashes in and occurred shortly after the spread hit an extreme low. As of May 15, the spread between these notes was about basis points, with the year yield at 2.

To put this in historical context, the table below breaks down yield spreads into five "brackets," each tallying the same number of returns -- with Bracket 1 including the narrowest spreads, and Bracket 5 the widest. Reviewing the data back to , the current yield spread is in the third quintile -- on the high end of "average," as this metric goes.

Over the past 15 years, stocks have performed well when yield spreads are relatively wide. On the other end of the spectrum, Brackets 1 and 2 show the benchmark index wavering between modest gains and notable losses, with the positive and negative returns closer to parity. When spreads are wide, banks that borrow at short-term rates and lend at longer-term rates experience better lending margins -- and are thus more willing to lend, given the potentially increased profits from such lending activity.

When borrowing needs are more likely to be met by lenders, new projects and expansion are more likely to occur, thereby contributing to earnings growth. Based on this historical data, it would appear that Bracket 4 is the "sweet spot" for stocks -- which means we'd want to see the spread widen from here.

In fact, the direction of this indicator may be just as relevant as the absolute reading. A yield spread that rises or widens from a low range can be viewed as bullish for stocks, while a declining narrower spread can be considered a potential red flag for an upcoming period of equity underperformance.

Peaks in TNX have been contained by its day trendline since last summer, including the pop earlier this month.

Access to this page has been denied.

On the other hand, TLT is currently finding its footing at this moving average -- setting the stage for a possible repeat of TLT's April test of support at its day, which preceded a substantial month advance in the shares. Buy Calls on Activision Blizzard, Electronic Arts Stocks Right Now.

Dow Jones Industrial Average Dips; Tech, Healthcare Stocks Lift Nasdaq. Why Traders Must Watch the Yield Curve.

CANADA FX DEBT-C$ strengthens with oil price, yield spreads narrow - gepahotalefi.web.fc2.com

The TNX Chart Level That Could Be Key for Stocks. How Stocks, Gold, Bonds, and the Dollar Perform On Fed Days. The Nikkei Takes on 20K, Again. MY ACCOUNT CONTACT US SEARCH. ABOUT US NEWS AND ANALYSIS TRADING SERVICES OPTIONS EDUCATION BROKER CENTER 30 FREE TRADES.

What's the Link Between Yield Spreads and Stocks? A deeper dive into the historical correlation between stocks and the 2-year and year yield spread. Stocks quoted in this article: Welcome to Schaeffer's Investment Research! We are a privately held provider of stock and options trading recommendations, options education, and market commentary, headquartered in Cincinnati, Ohio.

Founded in by industry pioneer Bernie Schaeffer, we've since become a trusted source of research and analysis for individual investors and major financial media outlets alike. KEEP READING SPX Buy Calls on Activision Blizzard, Electronic Arts Stocks Right Now Dow Jones Industrial Average Dips; Tech, Healthcare Stocks Lift Nasdaq TNX Why Traders Must Watch the Yield Curve The TNX Chart Level That Could Be Key for Stocks TLT Why Traders Must Watch the Yield Curve How Stocks, Gold, Bonds, and the Dollar Perform On Fed Days.

About Us Trading Services Contact Us Advertise with Us Sitemap Privacy Policy Additional Legal Notice. Unauthorized reproduction of any SIR publication is strictly prohibited.