Taxation of restricted stock units in india

ESPP, ESOP and RSU are benefits granted to individuals during their first job.

The benefits are included in their CTC package, but most employees find it hard to understand these benefits and often confuse them with each other.

Following is an explanation of each benefit and the tax implications associated with them. Restricted Stock Units can be understood fairly easily. A vesting period is basically the duration for which the employee must wait to claim the shares allotted by the company.

RSUs have been identified as a great means for companies to reward their employees, like WIPRO, who rewarded 4. RSUs are also a relatively good means for an employer to ensure that their employees stick with them for the long term.

Employee Stock Options are usually offered to employees of the biggest organisations in India, particularly IT companies that are listed outside the country. An individual with a stock option is one who has the right to purchase a stock at a future date and at a predetermined price decided at the time the individual took those stock options.

Basically the future market price of a stock does not matter and the individual will always have the option to purchase the stock at the predetermined price. However, in case the current market price of the stock is lower than the predetermined price, then the customer can opt to not exercise the stock option. For instance, if an individual joins a company on the 1 st of January, , and receives ESOPs with a three-year vesting period from the company and the vesting price is set at Rs.

However, in case the price of the stock has increased to Rs. In total, the individual makes a profit of Rs. Now, in case the value of a stock reduces from Rs. The money contributed towards the plan accumulates over a few months before the employee decides to purchase stock from the company at a discounted price.

The ESPP will determine the discount the employee will receive.

RSU, ESPP and ESOP - Understanding Meaning and Taxation

However, it is usually the minimum price at the start and end of the ESPP. For instance, if a company offers an ESPP that can be opted for twice in a year, there are two windows — January to June and July to December. The company must be informed beforehand by the employee regarding the amount of money they would like to contribute on a monthly basis. Suppose an individual opts the January to June window and contributes Rs.

If the price of the stock was Rs. The rules that govern the taxation of ESPP, ESOP, and RSUs are the same as they all deal with stocks that an employee receives and the taxation rules are also fairly easy to understand.

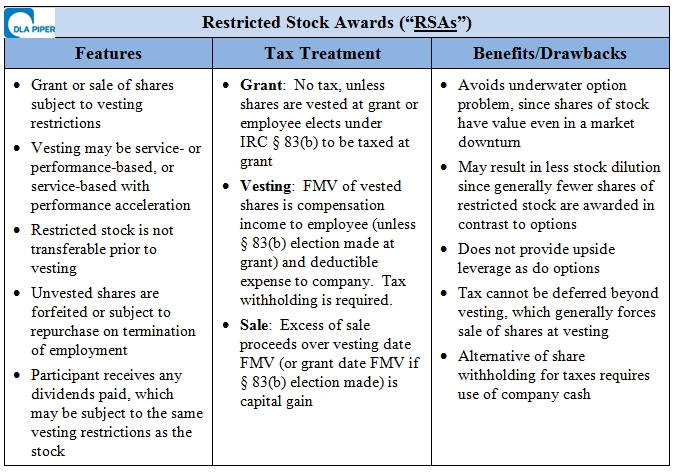

How Restricted Stock And RSUs Are Taxed

In fact, there are only two rules, viz. When an employee sells their ESPP, ESOP or RSU once the vesting period is complete and receive their money, it is their duty to pay tax on that amount in India.

The nature of the gains will determine the amount of tax the employee will have to pay. In case the shares are sold with a year of acquiring them, the gains resulting from such a sale are known as Short Term Capital Gains , and shares sold after a year of acquiring them are known as Long Term Capital Gains. Returning you to where you were Sign in with Facebook Recommended for the best experience. Home Tax Understanding the Meaning and Taxation of RSU, ESOP and ESPP Understanding the Meaning and Taxation of RSU, ESOP and ESPP.

Understanding the Meaning and Taxation of RSU, ESOP and ESPP. Restricted Stock Units RSU: Employee Stock Options ESOP: Employee Share Purchase Plan ESPP: Taxation on ESPP, ESOP and RSU: For Taxes to be paid in India: For Stocks listed on Foreign Stock Exchanges: TAX Income Tax Refund Status Pay Tax with Credit Cards Direct Tax Indirect Tax Stamp Duty Education Cess Entry Tax Road Tax Union Budget Income Declaration Scheme Tax Rebate Tax Planning Self Assessment Tax OLTAS Green Tax Deferred Tax Inflation Index Advance Tax HRA Calculation Gratuity Gross Salary and CTC Professional Tax Gross Salary VAT Return VAT Calculation VAT and Service Tax On Restaurant Bill VAT Sales Tax Central Sales Tax CST Capital Gains Tax on Shares Capital Gains Tax Capital Gain Calculator Service Tax Service Tax On Rent Filing Service Tax Return Goods And Service Tax GST ESOP 7th Pay Commission.

Income Tax Income Tax Slab Income Tax Slabs Income Tax Return Income Tax Refund Income Tax for Senior Citizens Which ITR To File Medical Reimbursement ITR-V to Income Tax Department Income Tax For Pensioners Income Tax Calculator Income From Other Sources Income From House Property How To Calculate Income Tax e-Filing ITR.

TDS How To Calculate TDS From Salary How To Claim TDS Refund Conveyance Allowance Dearness Allowance Leave Travel Allowance Special Allowance TDS Rates Chart TDS Rates Medical Allowance Tax Benefit On Tuition Fees City Compensation Allowance Double Taxation Avoidance Agreement Tax Exemptions Tax Benefits On Loans Tan Number How To File TDS Returns Tax Deductions Under 80C Tax Benefits For Consultants Advance Tax Exception TDS on Immovable Property Fringe Benefit Tax Tax Benefits For Education Loans.

Deduction Under Section 80G Deductions Under 80C Form 10C Form 16 Form 16 And 16A Form 16A Form 16B Form 24G Form 24Q,26Q,27Q,27EQ,27D Form 26AS Form 27C Form 49B Section A, B And C Section 24 Section 80C and 80U Section 80CCF Section 80CCG Section 80DD - Deductions On Medical Expenditure Section 80E Section 80U Section 87A.

Error (Forbidden)

Goods and Service Tax GST. Aadhar Atal Pension Yojana Auto Insurance Car Insurance Car Loan Car Prices in India Check Credit Score For Free Credit Card Debit Card Driving Licence EPF Education Loan Equifax Fixed Deposit Gas Connection Gold Rate Today Health Insurance Home Insurance Home Loan ICICI IFSC Code Income Tax Insurance Kisan Vikas Patra Life Insurance Loan MCLR Mediclaim Policy Mutual Funds NPS NSC Online Gas Booking PAN PPF Passport Personal Loan Pradhan Mantri Awas Yojana Property Tax Recurring Deposit Savings Account Senior Citizen Saving Scheme Silver Price Sukanya Samriddhi Yojana TDS Term Insurance Two Wheeler Insurance Two Wheeler Loan Used Car Loan VAT VISA VPF Voter ID.

CIBIL Tax Bank IFSC Code EMI Calculator Saving Schemes Singapore Malaysia Philippines UAE Mexico.

Restricted Stock & RSUs: Taxes and Key DecisionsSubscribe to our newsletter. About Careers Contact Us Blog Terms.